Shared illusions in money and what sustains them

What illusion causes us to see gold, money and crypto as valuable, and what could break the illusion?

All forms of money are a shared illusion. Fiat money can be burnt to provide some energy, but that would be a "waste of money". At the same time, they're really just numbers on pieces of paper, or in computers. Gold is shiny, but largely useless.

What gives fiat, gold and crypto value is that others believe it has value. If we think of money as a product, it's a product with easy resalability. We know we can buy the product today, and sell it tomorrow at roughly the same "price".

Gold

Let's start with gold. It's one of the oldest forms of money. Before gold was used, cows, seashells, lead ingots and even weapons were used as money. All of these had downsides, being hard to divide up, easy to create more of, not durable, etc etc.

Gold fixed many of these issues. While at the time not having much value aside from being shiny, it has scarcity. It’s difficult to find more gold. It's durable. It can be divided into smaller units. It was, in short, the best option available to store and thus exchange value in.

Gold was in use in Egypt in 1500 BC, and gold coins were being minted in Lydia in 600 BC. The Romans used gold coins (Aureus & Solidus), the Florentines had the Florin. Gold has a very long history of being used as money, longer than anything else. Yet we don’t use gold or gold coins as money anymore. What broke the illusion?

For all gold’s advantages, it has its flaws. While it's divisible, it’s not that divisible. 1 gram of gold today is worth ~$50. It’s not easy to transact with over large distances. Theft and robberies are a thing in all ages. It’s possible, and profitable, to counterfeit coins.

A way to solve many of these issues is through custodians. Deposit your gold coins at a trusted money-dealer, and they would provide you with an affidavit stating you held coins. You could then transact using your credit – in smaller denominations, and over large distances.

This, at the same time, is gold’s weakness. Because it is hard to transact with in and of itself, custodial solutions arose. Custodial solutions led to people exploiting the gold they had in custody, creating more claims on the gold than they had gold in their vaults.

The government confiscating gold didn’t exactly help either – showing that gold, while valuable, was clearly physical and hard to move or hide from theft and seizure.

Finally, gold’s illusion of value could be broken in a more definitive way. Deepsea gold mining or asteroid mining could catapult the supply of gold, decreasing its value.

Gold’s illusion was never fully broken, gold just got less relevant over time. Given that gold itself was not ideal to use as money, custodial solutions remained needed, even after that trust was broken time and time again. At some point, this lead to a move to fiat currencies.

Fiat currencies

Fiat currencies in most cases started out as being gold-backed. The pound, US dollar and most other currencies in the early 1900s were exchangeable into gold at a fixed exchange rate. At some point, convertibility was suspended, then never reinstated.

So began the illusion of value in fiat currencies. With nothing truly backing them, they still retained value because everyone else saw them as having value. What else does fiat, in this example the USD, have going for it to retain its illusion?

It’s easy to transact with, quite divisible, and can be transported cheaply over large distances. It’s relatively easy to verify that your paper money is not counterfeit. Perhaps most importantly, it has a large network effect due to governments wanting taxes paid in it and making it legal tender, forcing people to accept it. It’s a shared illusion that is incentivized by governments.

So what are the downsides? What could break the illusion of fiat’s value?

For one, the government can choose to break the illusion of value. India’s government recently decided, virtually overnight, that 500 and 1000 rupee bills were no longer legal tender.

Interestingly India recently announced their own digital currency (a so called CBDC, Central Bank Digital Currency), opening up the possibility of at some point declaring all paper money no longer legal tender.

As is illustrated by the Indian government’s banning of 500/1000 rupee notes fiat, by its very definition, is custodial. While you can keep paper money in your pocket, you are not the one deciding on the supply and value of the paper money.

With gold, a government would need to physically seize the asset to be able to access its value. With fiat, there is no such need. What a government (or central bank) can do instead is dilute everyone’s stake in the total amount of paper money. It’s far easier to control one location to print money from than it is to coerce millions of people to hand over their gold.

This is what we have seen with fiat money time and time again. The German experience is an interesting one here. Starting with the gold mark in 1871, moving to the Papiermark in 1914 (no longer backed by gold), which was replaced by the Rentenmark (1923), then the Reichsmark (1924), to be replaced by the Deutsche Mark (1948).

In Argentina, people are so used to a new currency being given out, then being debased, then being replaced by a new currency that they no longer see the peso as the de facto currency, but instead prefer to save in USD.

Al Jazeera: The US dollar is sewn into Argentina’s economy and its culture

Argentinians are well aware that their currency is a soft currency, prone to debasement and not a good store of value. They prefer to hold a harder currency like USD, quote prices in USD, and where possible accept payment in USD.

As an interesting aside – as in many cases where governments are aware that their sovereign currency is a weak one, Argentina has a long history of capital controls. These do not stop the outflow of local currencies, but tend to delay them.

Fitch: Argentina’s Capital Controls to Remain in Place for the Foreseeable Future

Debasement of currency is nothing new, and Argentina's situation is in no way unique. See for example this fascinating thread on coin debasement in Roman times.

This is the major weakness of fiat, and is what could break its spell (and arguably already is doing so). All fiat is by design custodial, on the largest possible scale. You hold a nominal, fixed amount of the currency, but someone else decides on the total supply of the currency.

Because of this, fiat’s illusion has been shattered many times. The euro and the dollar are the exception, not the rule, and even these have been and are being debased/devalued annually.

“Bitcoin fixes this”. Does it? Largely, but not entirely.

Crypto

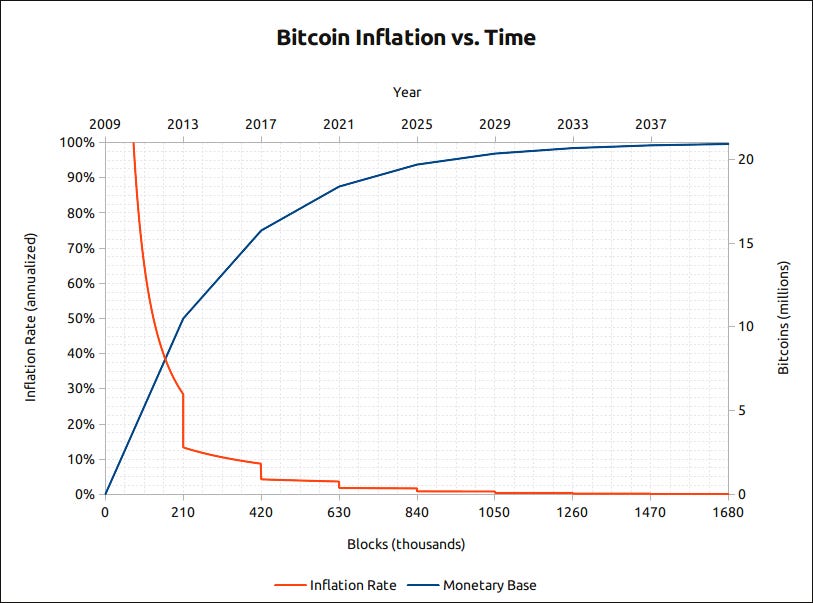

The positives – Bitcoin fixes fiat’s major weakness. While fiat’s supply has always ended up being increased, debasing its value, Bitcoin’s supply is known and fixed. There will never be more than 21 million BTC. This makes it an attractive option as a store of value.

It has more going for it. Compared to gold, Bitcoin is easier to transport, cheaper to transact with and cheaper to verify. It’s infinitely harder to seize, and highly divisible.

However, it has some fundamental weaknesses too. While it’s cheaper to transact with, it can still get quite expensive. Fees have reached $50+ at points, even though barely anyone uses Bitcoin. It’s quite fast to transfer, but waiting an hour for a transaction to settle is still long.

It’s hard to seize Bitcoin, but Bitcoin’s slowness and high costs mean many use custodial solutions, making it easier to seize. The more people try to use Bitcoin, the more expensive to use and slower it becomes.

Other weaknesses revolve around mining. Mining equipment is easy to spot and seize.

More importantly, Bitcoin becomes censorable when entities get control of a large percentage of the network’s hashrate. This in itself does not need to be an issue. However, Bitcoin’s design actively incentivizes big miners getting ever bigger.

As an example, Bitcoin's security comes from decentralization. At the same time, mining Bitcoin comes with economies of scale due to the way Bitcoin is designed. In other words, Bitcoin is designed to encourage centralization over time.

This is how Bitcoin’s illusion can be (and is being) broken. Its value derives from decentralization and security. When security and decentralization start being questionable, the illusion (and value) are shattered.

Another reason Bitcoin’s illusion is being broken is that it’s hardly usable as money already, even before becoming broadly adopted. Lightning unfortunately does not fix this.

With Bitcoin and blockchain, we’re utilizing new technology to approach the ultimate form of money. However, Bitcoin itself is not yet perfect money. For that, we have to look at how the crypto market has continued to evolve and innovate.

We can theoretically create a form of money that transfers instantly to anywhere in the world, with $0 fees, that is scalable and that is cheap to verify. There would be no need to resort to custodial solutions for such a (near-)perfect form of money.

To store value in it we’d want it to have a known supply, like Bitcoin. We’d want it to be even harder to seize than Bitcoin (no need for custodial solutions), and we’d want it to fix Bitcoin’s flaw of decreasing decentralization and security over time. For institutions to step in, we’d also want it to be environmentally friendly.

The above describes Nano. A fixed supply money, that becomes ever more decentralized and secure over time. Low energy usage. Extremely divisible, and cheap to verify. Scalable, so custodial solutions are unnecessary.

Why Nano may be the ultimate store of value and reserve currency.

Transacting is instant, limited only by light speed. Moving your money from Argentina to Zambia can be done within a second, with no one able to stop the transaction and with $0 fees.

How could Nano’s illusion be broken? Governments could try to make it difficult to exchange fiat money into Nano, but can not stop the network itself. The network runs on nodes that can be moved at the speed of light, and can be run from anywhere.

A fatal flaw in the code could shatter confidence, as it could in Bitcoin. So far, we’ve seen Nano do 140 million transactions without a rollback, a doublespend, or a security bug. Every day, confidence grows.

An entity could try to attack the network by getting a majority of the stake. This would already cost many billions to do, and becomes more expensive with an increasing market cap. Additionally, anyone doing so would be essentially burning their own money.

We’re already seeing Nano’s network effect expanding and the shared illusion of its value getting stronger. As a practical example, ~17,000 Ethereum miners recently started using Nano as their preferred currency, since Nano is a more efficient solution for digital cash than Ethereum is.

I believe this growth of Nano’s network effect and shared illusion will continue. Individuals and companies tend to gravitate towards more efficient solutions over time. Why stick with telegrams when you can have telephones? Why stick with Blockbuster when you can have Netflix?

In the long run, anything can happen. It is my belief that with increasing knowledge about how money works and with people increasingly having the ability to escape weaker currencies, the Argentinian experience will be illustrative.

When given the choice, why hold a currency knowing it will be debased? Why hold a weaker store of value, or use a less efficient medium of exchange? Why settle for less, when better options are available?

Illusions only last so long. I believe our current paradigm of fiat currencies is one we'll look back on and study extensively in the future, to see how this illusion managed to last so long.

Thanks for reading this long thread. Check out my other articles for more content on the economics behind cryptocurrencies and money in general. Comments and feedback are always very welcome.